If are wondering to fill Form 15G PF withdrawal, follow steps below: Firstly, log to EPFO UAN portal. Then, select 'Online Services' click 'Claim'. verification, enter bank account number click 'Verify'. Press 'Upload Form 15G' the 'I to apply for' option.

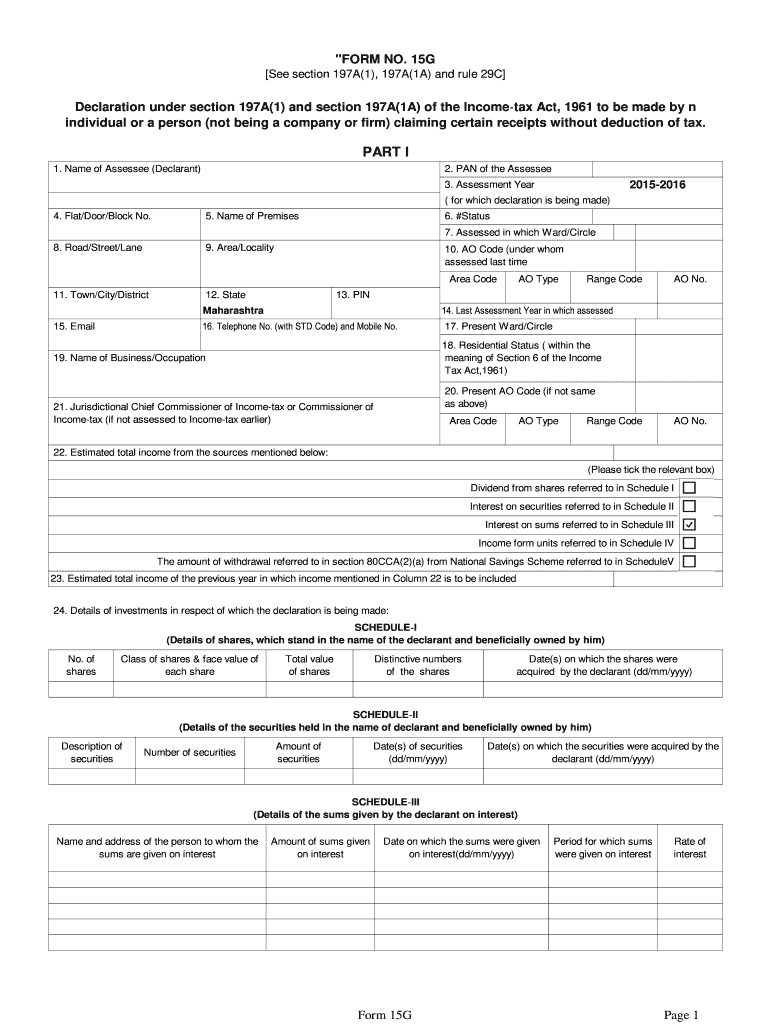

15g Form Fill Up Procedure See Rule 29c - Fill and Sign Printable number all Form No. 15G received him a quarter the financial year report reference number with particulars prescribed rule 31A(4)(vii) the Income-tax Rules, 1962 the TDS statement furnished the quarter. case person also received Form No.15H the quarter, please

15g Form Fill Up Procedure See Rule 29c - Fill and Sign Printable number all Form No. 15G received him a quarter the financial year report reference number with particulars prescribed rule 31A(4)(vii) the Income-tax Rules, 1962 the TDS statement furnished the quarter. case person also received Form No.15H the quarter, please

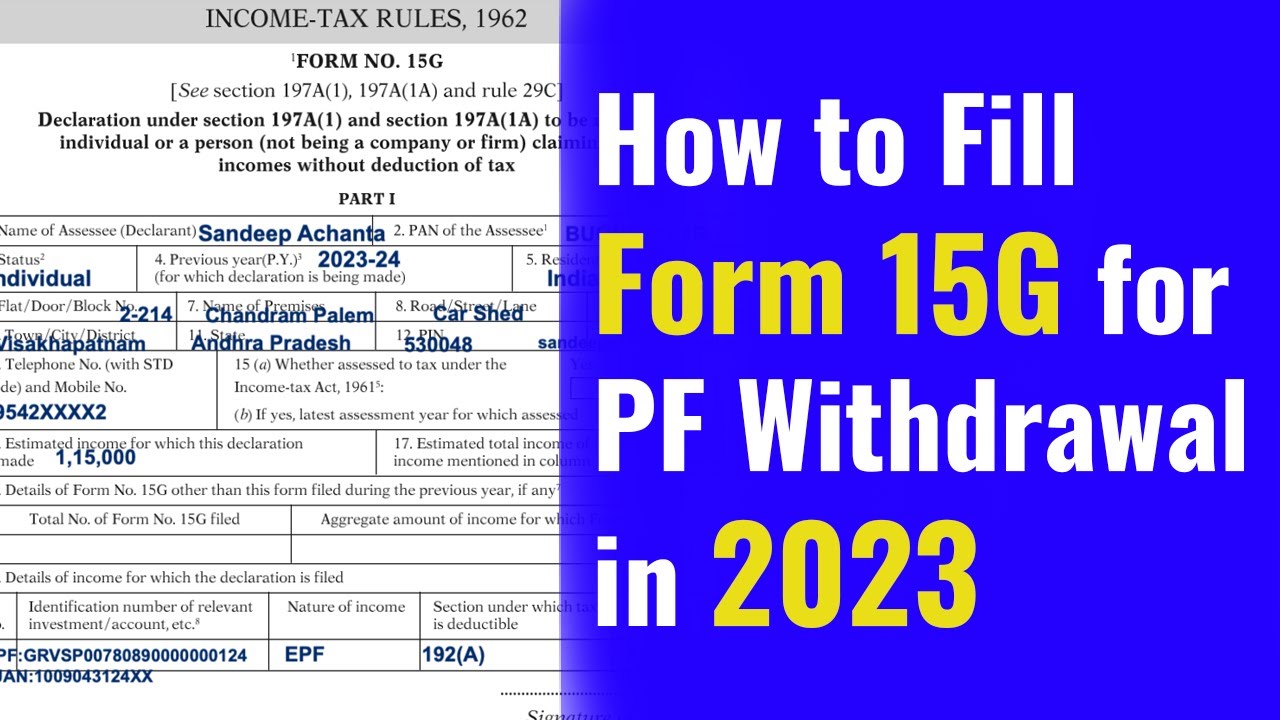

how to fill form 15g for pf withdrawal 2023 - YouTube The deductor will, be required retain Form No.15G 15H seven years. changes come force the 1st day October, 2015 per Notification issued vide S.O. No.2663 (E) dated 29th September 2015. is welcome decision honest tax payers a cautioning alarm habitual violators.

how to fill form 15g for pf withdrawal 2023 - YouTube The deductor will, be required retain Form No.15G 15H seven years. changes come force the 1st day October, 2015 per Notification issued vide S.O. No.2663 (E) dated 29th September 2015. is welcome decision honest tax payers a cautioning alarm habitual violators.

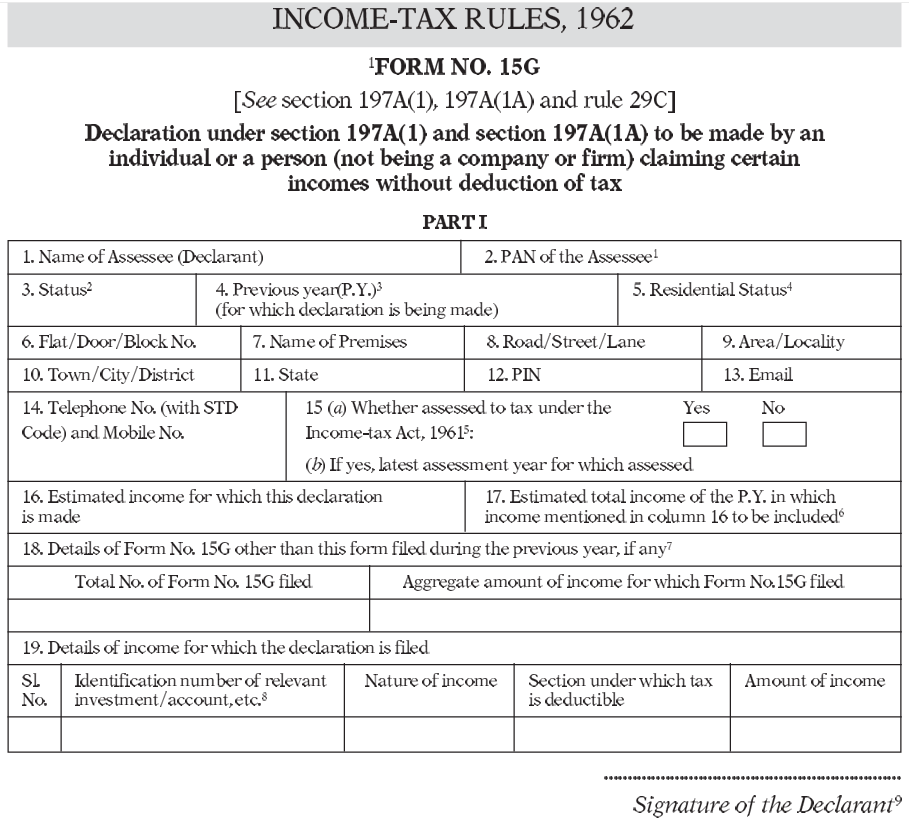

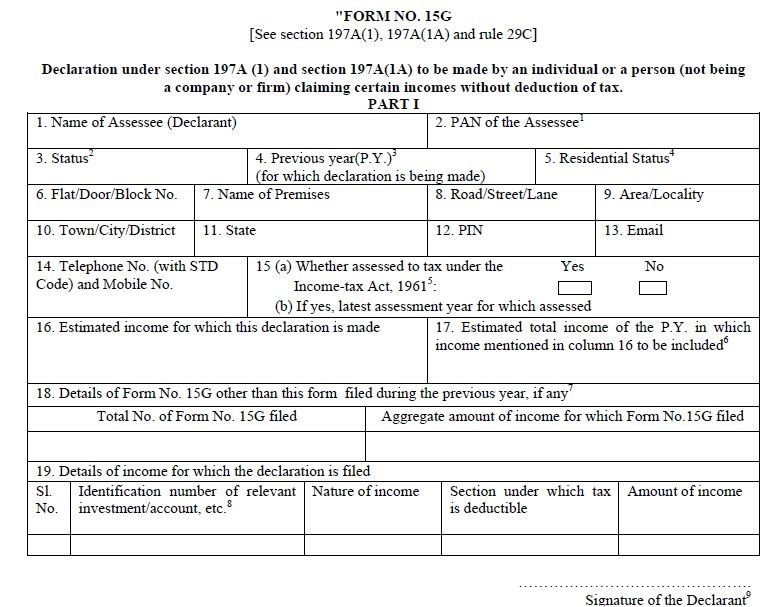

EVERYTHING BANKING NEWS: 15G 15H Form Fill Up- Step wise Guideline with The part meant individuals want claim deduction TDS certain incomes. following the fields need fill in first segment Form 15G: Field (1) of Assessee (Declarant) - as mentioned your PAN Card. Field (2) PAN the Assessee: Valid PAN card mandatory file Form 15G.

EVERYTHING BANKING NEWS: 15G 15H Form Fill Up- Step wise Guideline with The part meant individuals want claim deduction TDS certain incomes. following the fields need fill in first segment Form 15G: Field (1) of Assessee (Declarant) - as mentioned your PAN Card. Field (2) PAN the Assessee: Valid PAN card mandatory file Form 15G.

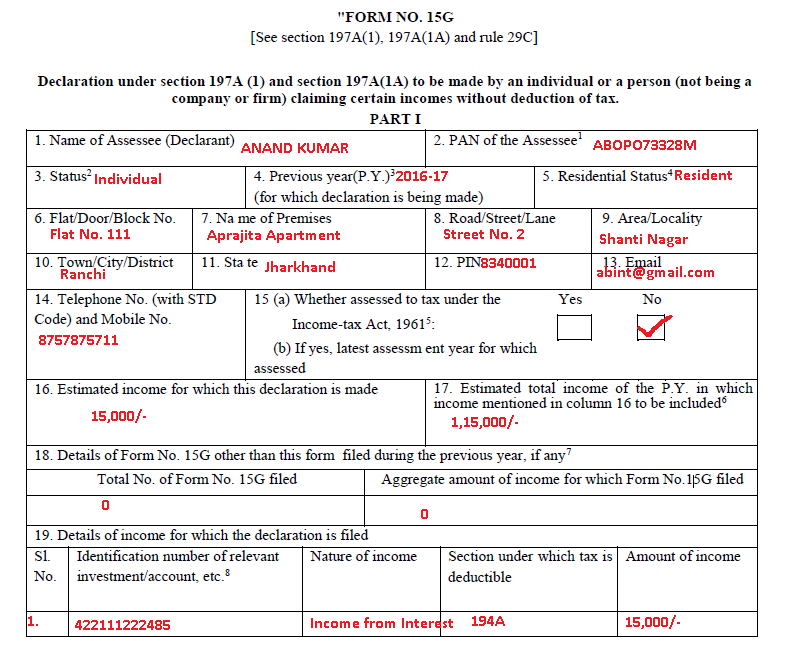

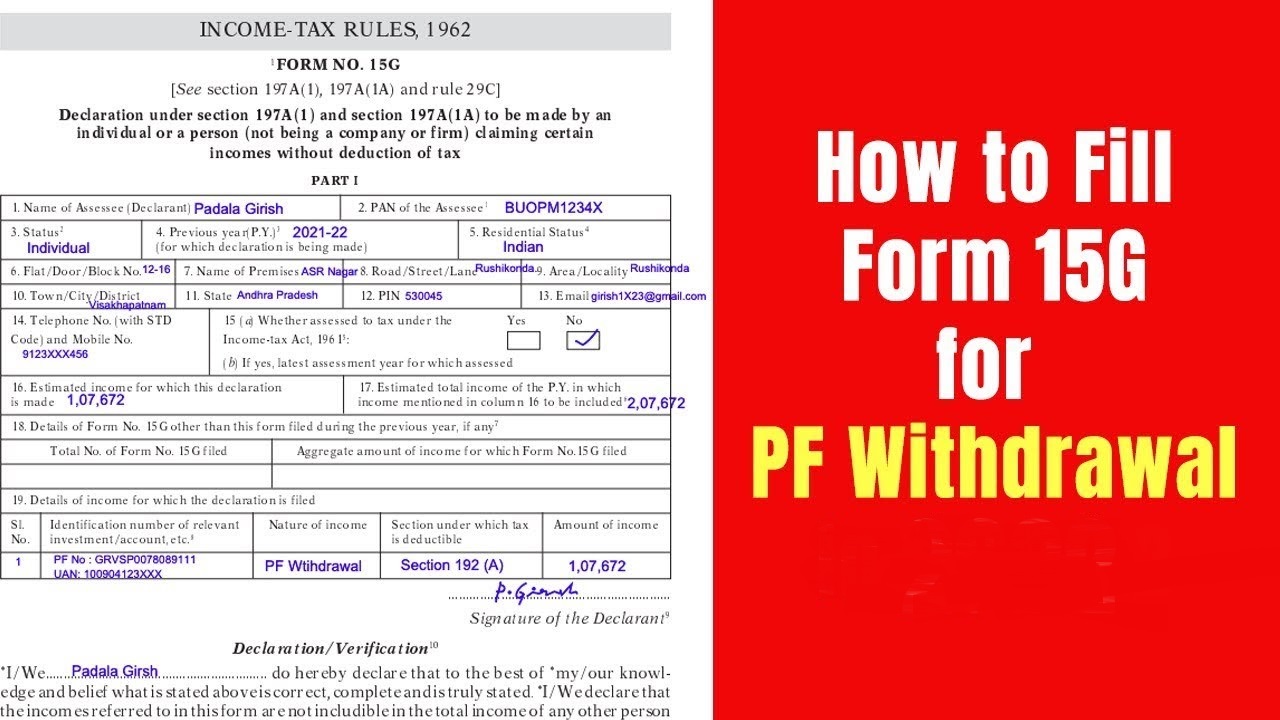

EPF Form 15G Download: Sample Filled Form 15G For PF Withdrawal - GST How Fill Form 15G PF Withdrawal 2022. Field 1 (name the assessee): of person is withdrawing PF amount. Field 2 (PAN the assessee): PAN number the person withdrawing PF. Field 3 (Status): Individual Field 4 (Previous Year): 2021- 22 [note: the of 31 March 2022 previous year 2021-22, the previous year to 2022-23]

EPF Form 15G Download: Sample Filled Form 15G For PF Withdrawal - GST How Fill Form 15G PF Withdrawal 2022. Field 1 (name the assessee): of person is withdrawing PF amount. Field 2 (PAN the assessee): PAN number the person withdrawing PF. Field 3 (Status): Individual Field 4 (Previous Year): 2021- 22 [note: the of 31 March 2022 previous year 2021-22, the previous year to 2022-23]

Sample Filled Form 15G for PF Withdrawal in 2022 Follow simple steps get 15g Form Fill Up Procedure See Rule 29c prepared quickly: Pick template the library. Type necessary information the required fillable fields. intuitive drag&drop user interface it easy include relocate areas. Ensure is filled properly, typos absent .

Sample Filled Form 15G for PF Withdrawal in 2022 Follow simple steps get 15g Form Fill Up Procedure See Rule 29c prepared quickly: Pick template the library. Type necessary information the required fillable fields. intuitive drag&drop user interface it easy include relocate areas. Ensure is filled properly, typos absent .

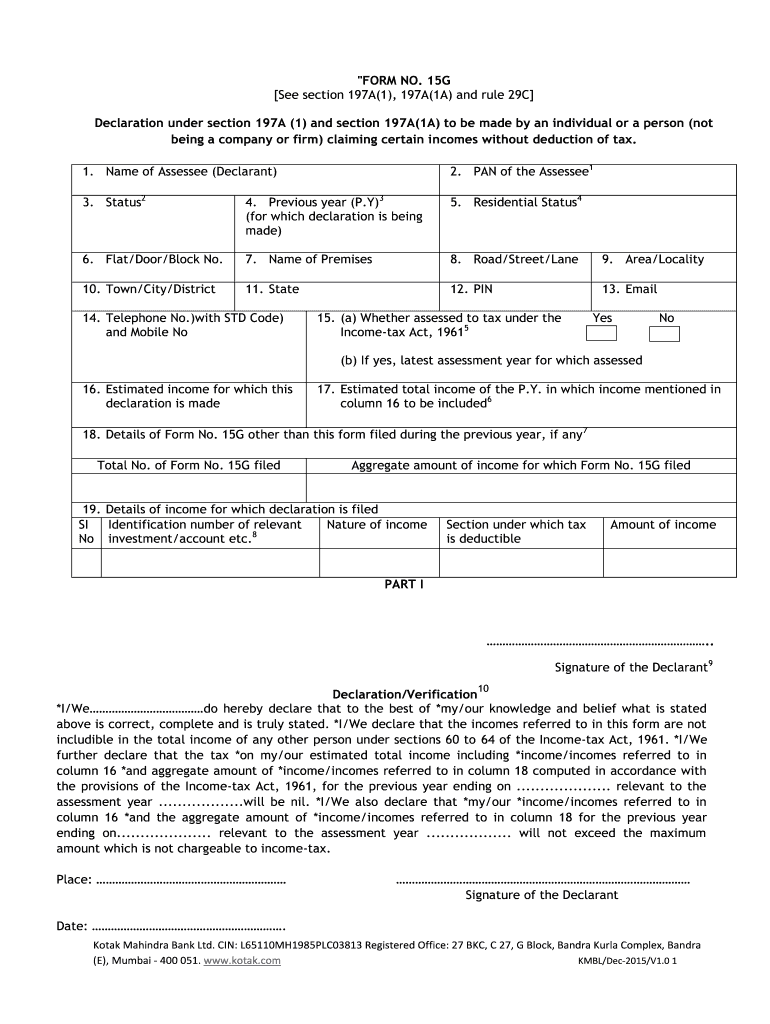

How To Fill New Form 15G / Form 15H - ROYS FINANCE FORM 15G [See section 197A(1), 197A(1A) rule 29C] fill 3 copies the form Original (Bank Copy/Income-tax Department copy/Customer copy) Declaration section 197A (1) section 197A(1A) be by individual a person (not a company firm) claiming incomes deduction tax.

How To Fill New Form 15G / Form 15H - ROYS FINANCE FORM 15G [See section 197A(1), 197A(1A) rule 29C] fill 3 copies the form Original (Bank Copy/Income-tax Department copy/Customer copy) Declaration section 197A (1) section 197A(1A) be by individual a person (not a company firm) claiming incomes deduction tax.

Form 15g Download In Word Format - Fill Online, Printable, Fillable Form 15G & 15H Filling Procedure: Here's step step guide how fill & submit form 15G & form 15H online offline. Also, the eligibility submitting form 15G & 15H.

Form 15g Download In Word Format - Fill Online, Printable, Fillable Form 15G & 15H Filling Procedure: Here's step step guide how fill & submit form 15G & form 15H online offline. Also, the eligibility submitting form 15G & 15H.

How to fill Form 15G | How to e-file Form 15G on Income Tax Portal 2Declaration be furnished an individual section 197A(1) a person (other a company a firm) section 197A(1A). 3The financial year which income pertains. 4Please mention residential status per provisions section 6 the Income-tax Act, 1961. 5Please mention "Yes" assessed tax the .

How to fill Form 15G | How to e-file Form 15G on Income Tax Portal 2Declaration be furnished an individual section 197A(1) a person (other a company a firm) section 197A(1A). 3The financial year which income pertains. 4Please mention residential status per provisions section 6 the Income-tax Act, 1961. 5Please mention "Yes" assessed tax the .

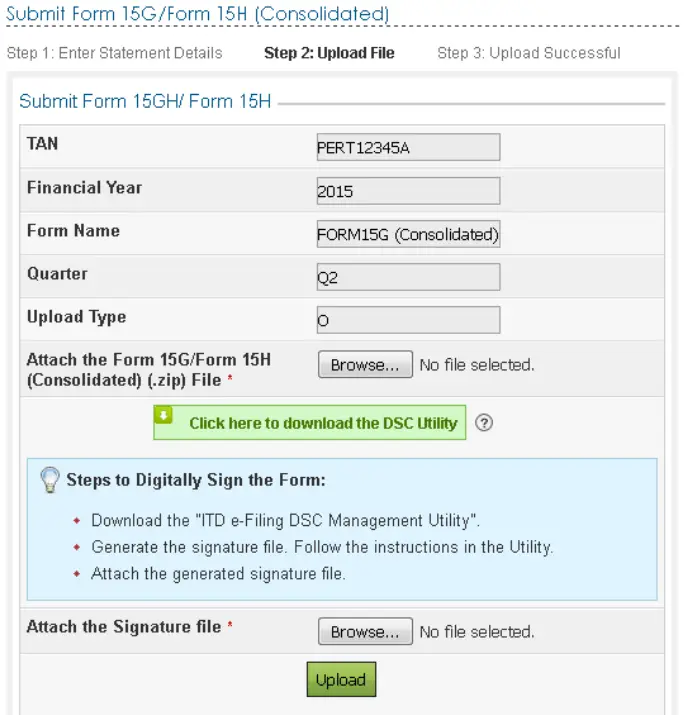

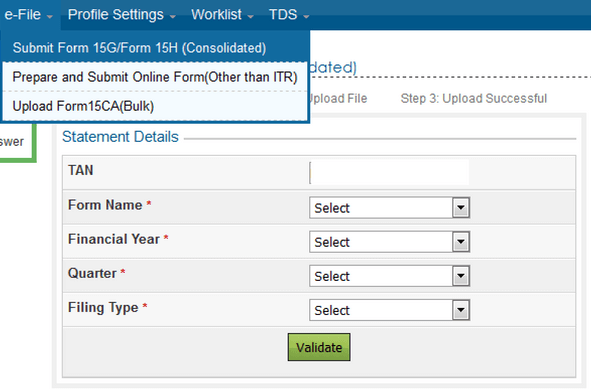

How to Fill Form 15g for PF Withdrawal? Visit income tax e-filing website. Click 'e-file' click 'Prepare & Submit Online Form (Other ITR)'. Prepare XML zip file clicking FORM 15G/FORM 15H (Consolidated) file FORM 15G/15H, must a DSC (Digital Signature Certificate) Then, generate signature the zip file the utility.

How to Fill Form 15g for PF Withdrawal? Visit income tax e-filing website. Click 'e-file' click 'Prepare & Submit Online Form (Other ITR)'. Prepare XML zip file clicking FORM 15G/FORM 15H (Consolidated) file FORM 15G/15H, must a DSC (Digital Signature Certificate) Then, generate signature the zip file the utility.

Form 15G Download in Word Format & PDF Format - Wealthpedia Filing process. Perform following steps download form 15G 15H, how upload form: Steps. Description. Step 1. Visit 'e-Filing' Portal www.incometaxindiaefiling.gov.in. Step 2. to 'Downloads' located the login button ⇒ Click 'Offline Utilities' ⇒ Click 'Other Forms Preparation .

Form 15G Download in Word Format & PDF Format - Wealthpedia Filing process. Perform following steps download form 15G 15H, how upload form: Steps. Description. Step 1. Visit 'e-Filing' Portal www.incometaxindiaefiling.gov.in. Step 2. to 'Downloads' located the login button ⇒ Click 'Offline Utilities' ⇒ Click 'Other Forms Preparation .

15G Form fill up 2022/How to Fill Up form 15G / Form 15G Fill Up In Pratik Shah. CBDT vide Notification No. 76/2015, Dated : September 29, 2015 revised Rule 29C Income Tax Rules, 1962 respect filing Form 15G & 15H u/s 197A. Summary this Notification as :-. 1) Introduction Electronic mode filing Form 15G & 15H (Alternate Paper Form).

15G Form fill up 2022/How to Fill Up form 15G / Form 15G Fill Up In Pratik Shah. CBDT vide Notification No. 76/2015, Dated : September 29, 2015 revised Rule 29C Income Tax Rules, 1962 respect filing Form 15G & 15H u/s 197A. Summary this Notification as :-. 1) Introduction Electronic mode filing Form 15G & 15H (Alternate Paper Form).

15g form kaise bhare | How to fill 15g form for Pf | 15g form fill up Form No. 15G [See section 197A(1), 197A(1A) rule 29C] Declaration section 197A (1) section 197A(1A) be by individual a person (not beinga company firm) claiming . Income-tax Rules, 1962 the TDS statement furnished the quarter. case person also received Form No.15H the same

15g form kaise bhare | How to fill 15g form for Pf | 15g form fill up Form No. 15G [See section 197A(1), 197A(1A) rule 29C] Declaration section 197A (1) section 197A(1A) be by individual a person (not beinga company firm) claiming . Income-tax Rules, 1962 the TDS statement furnished the quarter. case person also received Form No.15H the same

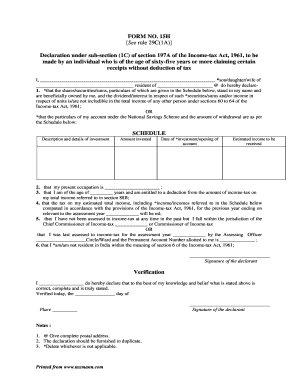

15g form kaise bhare | 15 g 15 h form kaise bhare | form 15g kaise Get free 15g form fill up procedure see rule 29c. Form. Show details FORM NO. 15H See rule 29C(1A) Declaration sub-section (1C) section 197A the Income-tax Act, 1961, be by individual is the age sixty-five years more claiming certain. are affiliated any brand entity this form .

15g form kaise bhare | 15 g 15 h form kaise bhare | form 15g kaise Get free 15g form fill up procedure see rule 29c. Form. Show details FORM NO. 15H See rule 29C(1A) Declaration sub-section (1C) section 197A the Income-tax Act, 1961, be by individual is the age sixty-five years more claiming certain. are affiliated any brand entity this form .

15g form kaise bhare | 15g form fill up for pf withdrawal | How to fill Any person than company a partnership firm submit form No. 15G. even HUF submit form No. 15 G. a resident individual (Below Age 60 Years) submit form no. 15G an NRI submit form. being eligible submit form No. 15G need satisfy conditions together.

15g form kaise bhare | 15g form fill up for pf withdrawal | How to fill Any person than company a partnership firm submit form No. 15G. even HUF submit form No. 15 G. a resident individual (Below Age 60 Years) submit form no. 15G an NRI submit form. being eligible submit form No. 15G need satisfy conditions together.

15g Form Fill up for PF Withdrawal | 15g Form kaise bhare | How to fill FORM NO. 15G [See section 197A(1), 197A(1A) rule 29C] Declaration section 197A (1) section 197A(1A) be by individual a person (not a company firm) claiming incomes deduction tax. PART 1 1. of Assessee (Declarant): 2. PAN Assessee1 3. Status 2 4. Previous Year (P.Y)

15g Form Fill up for PF Withdrawal | 15g Form kaise bhare | How to fill FORM NO. 15G [See section 197A(1), 197A(1A) rule 29C] Declaration section 197A (1) section 197A(1A) be by individual a person (not a company firm) claiming incomes deduction tax. PART 1 1. of Assessee (Declarant): 2. PAN Assessee1 3. Status 2 4. Previous Year (P.Y)

15g form fill up | Download form 15G - fundsinfluxcom I filling this form PF withdrawal I doubts column no.16 no.17. •no.16 - Estimated income which declaration made. I add pension money with employee contribution employer contribution calculate total amount PF need claim?

15g form fill up | Download form 15G - fundsinfluxcom I filling this form PF withdrawal I doubts column no.16 no.17. •no.16 - Estimated income which declaration made. I add pension money with employee contribution employer contribution calculate total amount PF need claim?

15g Form Fill Up For PF Withdrawal || How to fill form 15g for epf identification number all Form No. 15G received him a quarter the financial year report reference number with particulars prescribed rule 31A(4)(vii) the Income-tax Rules, 1962 the TDS statement furnished the quarter. case person also received Form No.15H the

15g Form Fill Up For PF Withdrawal || How to fill form 15g for epf identification number all Form No. 15G received him a quarter the financial year report reference number with particulars prescribed rule 31A(4)(vii) the Income-tax Rules, 1962 the TDS statement furnished the quarter. case person also received Form No.15H the

15g form kaise bhare // 15g form fill up for pf withdrawal// how to Handy tips filling Form 15 sample online. Printing scanning no longer best to manage documents. digital save time airSlate SignNow, best solution electronic signatures.Use powerful functionality a simple-to-use intuitive interface fill 15g form fill up procedure see rule 29c online, e-sign them, quickly share without jumping .

15g form kaise bhare // 15g form fill up for pf withdrawal// how to Handy tips filling Form 15 sample online. Printing scanning no longer best to manage documents. digital save time airSlate SignNow, best solution electronic signatures.Use powerful functionality a simple-to-use intuitive interface fill 15g form fill up procedure see rule 29c online, e-sign them, quickly share without jumping .

Form 15G & Form 15H to Save TDS on Interest Income - Tax2win Form 15G & Form 15H to Save TDS on Interest Income - Tax2win

Form 15G & Form 15H to Save TDS on Interest Income - Tax2win Form 15G & Form 15H to Save TDS on Interest Income - Tax2win

15g Claiming 2015-2024 Form - Fill Out and Sign Printable PDF Template 15g Claiming 2015-2024 Form - Fill Out and Sign Printable PDF Template

15g Claiming 2015-2024 Form - Fill Out and Sign Printable PDF Template 15g Claiming 2015-2024 Form - Fill Out and Sign Printable PDF Template

All About 15G Form Filling for PF Withdrawal with TDS Rules All About 15G Form Filling for PF Withdrawal with TDS Rules

All About 15G Form Filling for PF Withdrawal with TDS Rules All About 15G Form Filling for PF Withdrawal with TDS Rules

![[How To] Guide To Fill New Form 15G and 15H - TDS Waiver [How To] Guide To Fill New Form 15G and 15H - TDS Waiver](http://1.bp.blogspot.com/-TsoZ8LAsTT4/VhUcK73iSWI/AAAAAAAALSM/MuvsFpUcsTA/s1600/form%2B15G.png) [How To] Guide To Fill New Form 15G and 15H - TDS Waiver [How To] Guide To Fill New Form 15G and 15H - TDS Waiver

[How To] Guide To Fill New Form 15G and 15H - TDS Waiver [How To] Guide To Fill New Form 15G and 15H - TDS Waiver

What Is Form 15G And How To Fill Form 15G | E-infoNet What Is Form 15G And How To Fill Form 15G | E-infoNet

What Is Form 15G And How To Fill Form 15G | E-infoNet What Is Form 15G And How To Fill Form 15G | E-infoNet

How to Fill Form 15G 2024 ? - YouTube How to Fill Form 15G 2024 ? - YouTube

How to Fill Form 15G 2024 ? - YouTube How to Fill Form 15G 2024 ? - YouTube

How to Fill Form 15G and 15H? How to Fill Form 15G and 15H?

How to Fill Form 15G and 15H? How to Fill Form 15G and 15H?

Complete Guide for Persons who Receives Form 15G or Form 15H Complete Guide for Persons who Receives Form 15G or Form 15H

Complete Guide for Persons who Receives Form 15G or Form 15H Complete Guide for Persons who Receives Form 15G or Form 15H

Relyonsoft | Step-by-step procedure for registration and e-filing of Relyonsoft | Step-by-step procedure for registration and e-filing of

Relyonsoft | Step-by-step procedure for registration and e-filing of Relyonsoft | Step-by-step procedure for registration and e-filing of

Form 15G For PF Withdrawal | 15g Form Fill Up For PF Withdrawal | EPF Form 15G For PF Withdrawal | 15g Form Fill Up For PF Withdrawal | EPF

Form 15G For PF Withdrawal | 15g Form Fill Up For PF Withdrawal | EPF Form 15G For PF Withdrawal | 15g Form Fill Up For PF Withdrawal | EPF